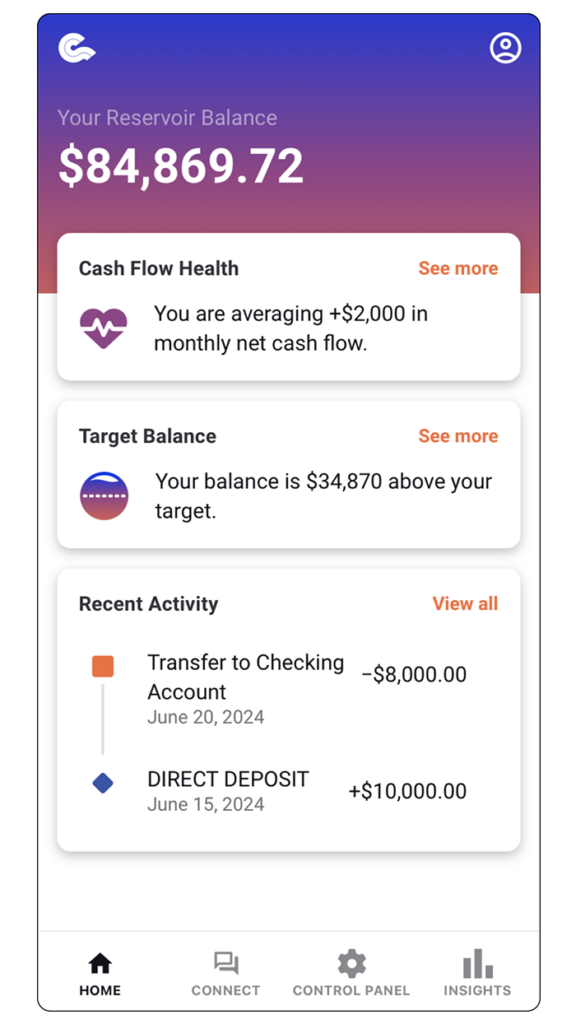

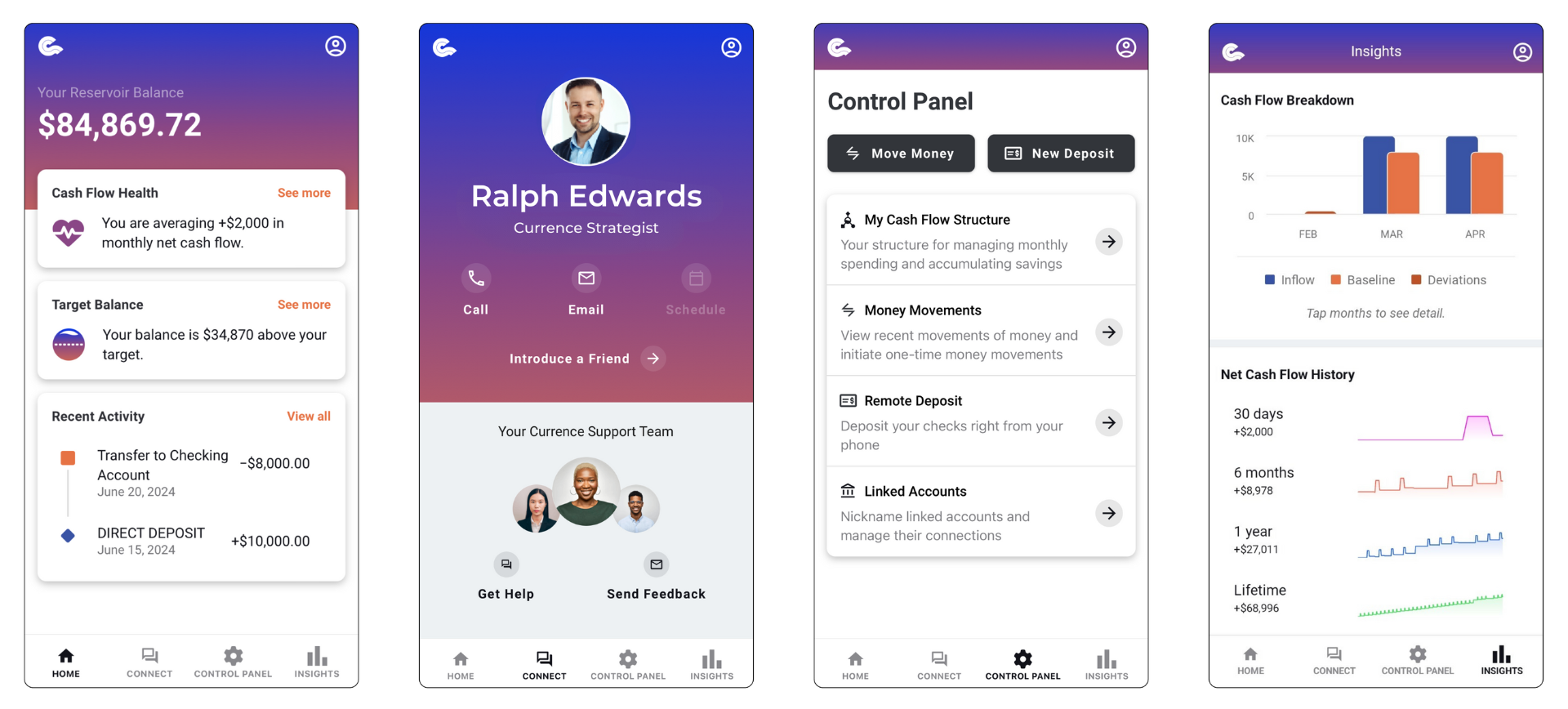

Spend and save smarter with Currence. Put structure to your cash flow and save before you spend. This change of direction in cash flow drives savings accumulation with upwards of 6x higher savings rates than the national average.

01

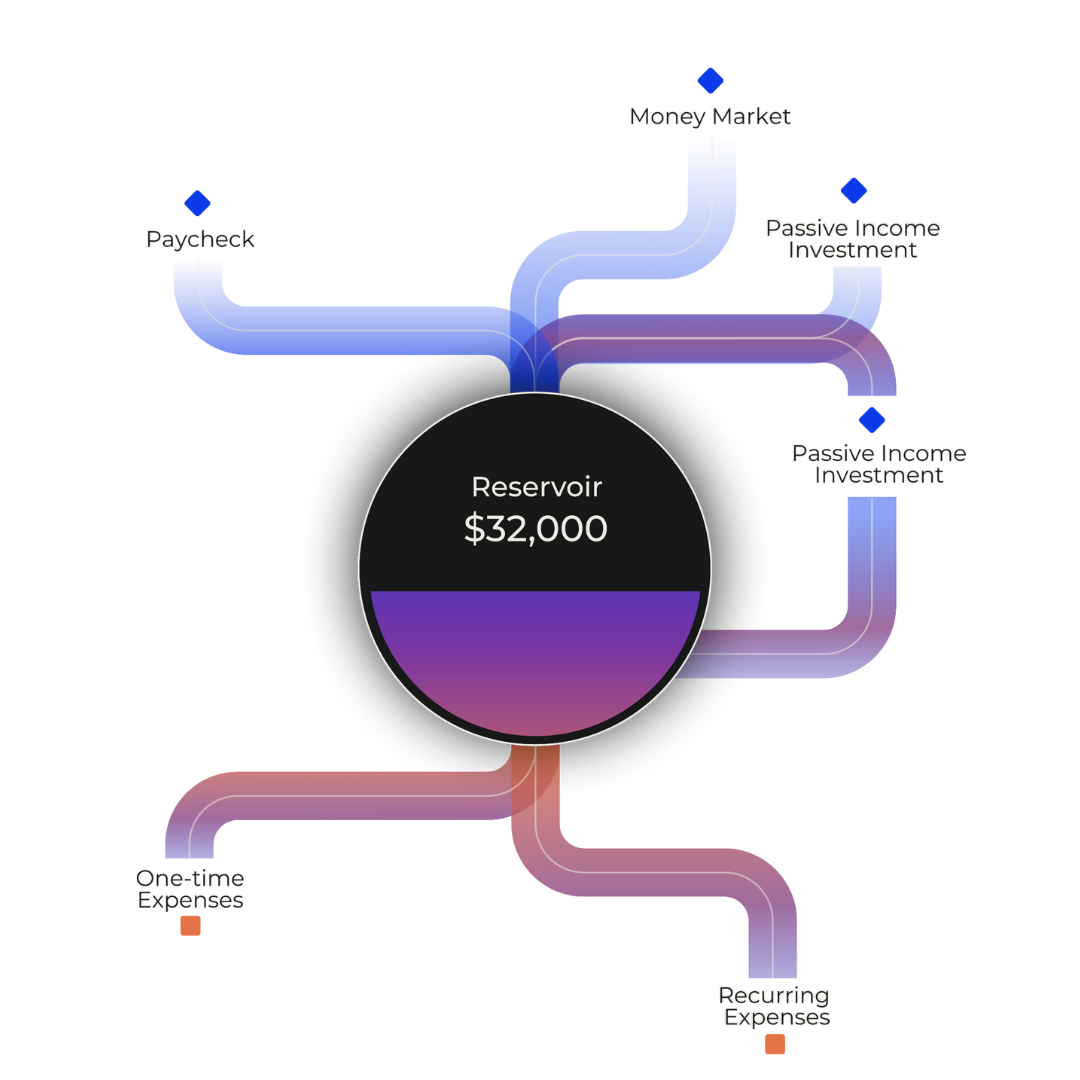

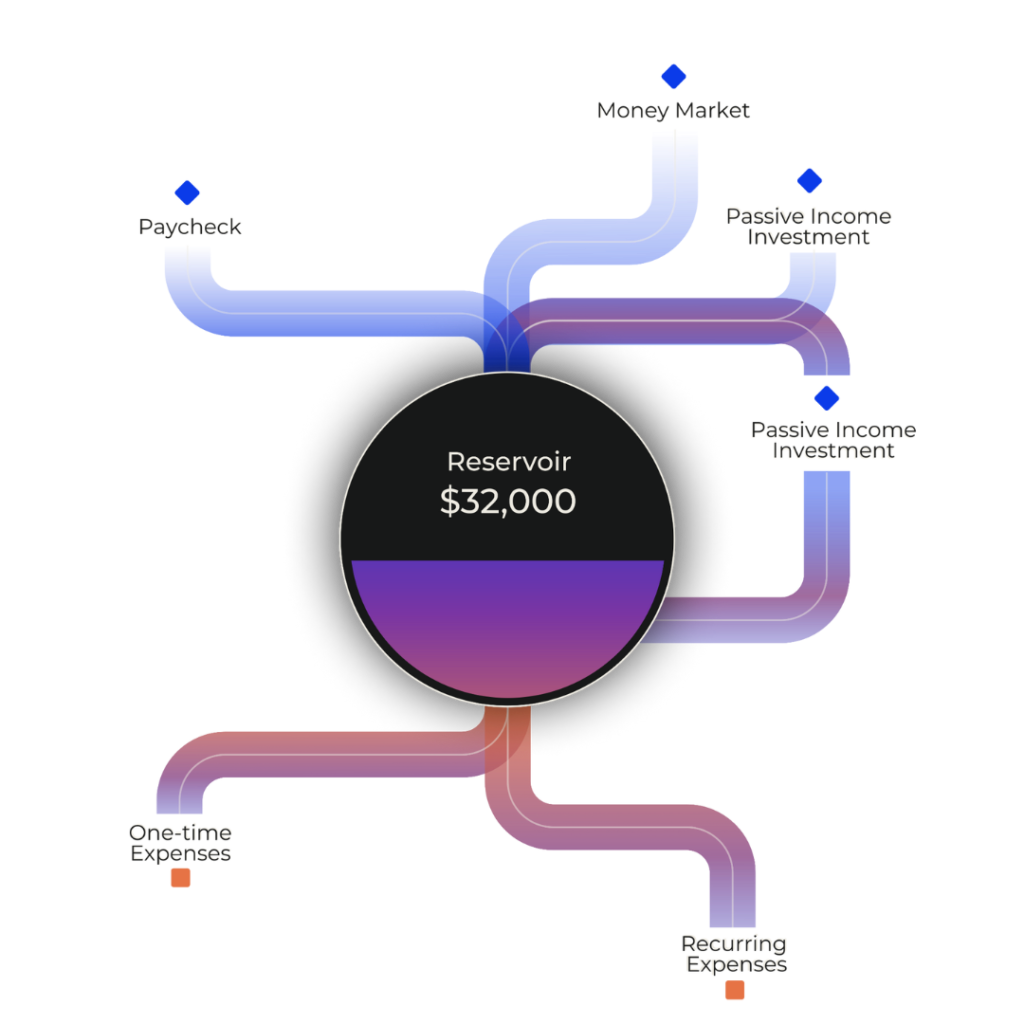

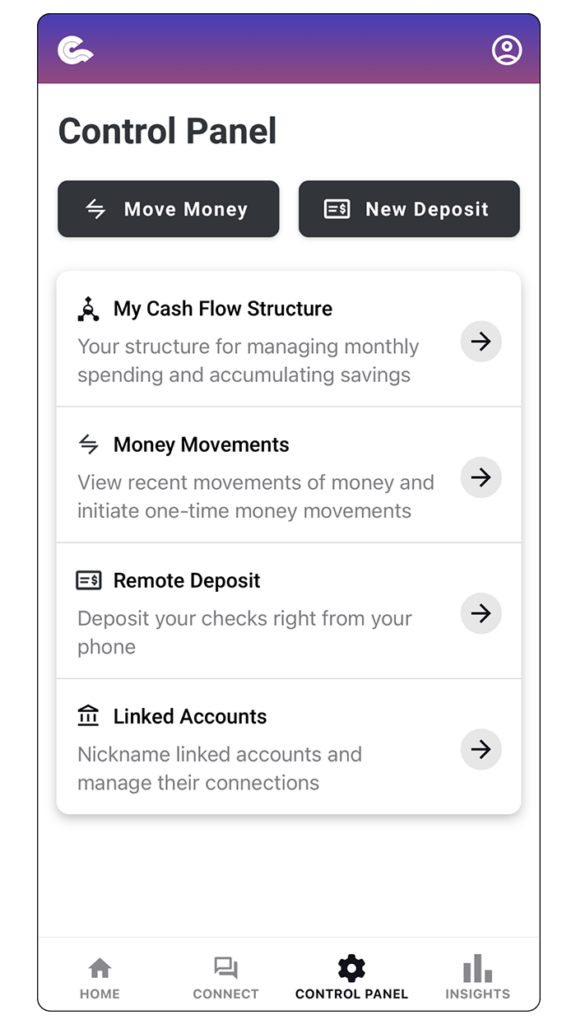

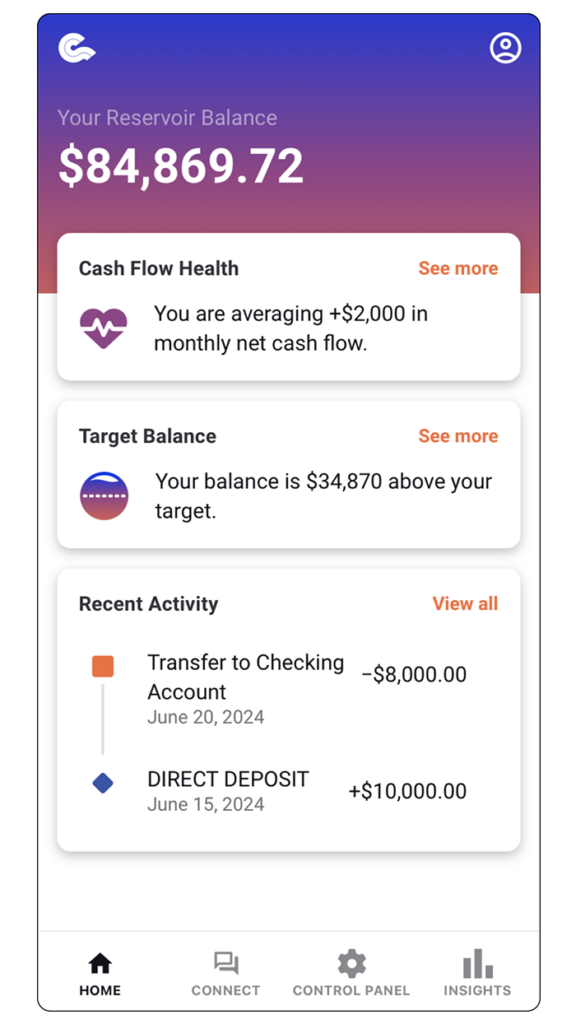

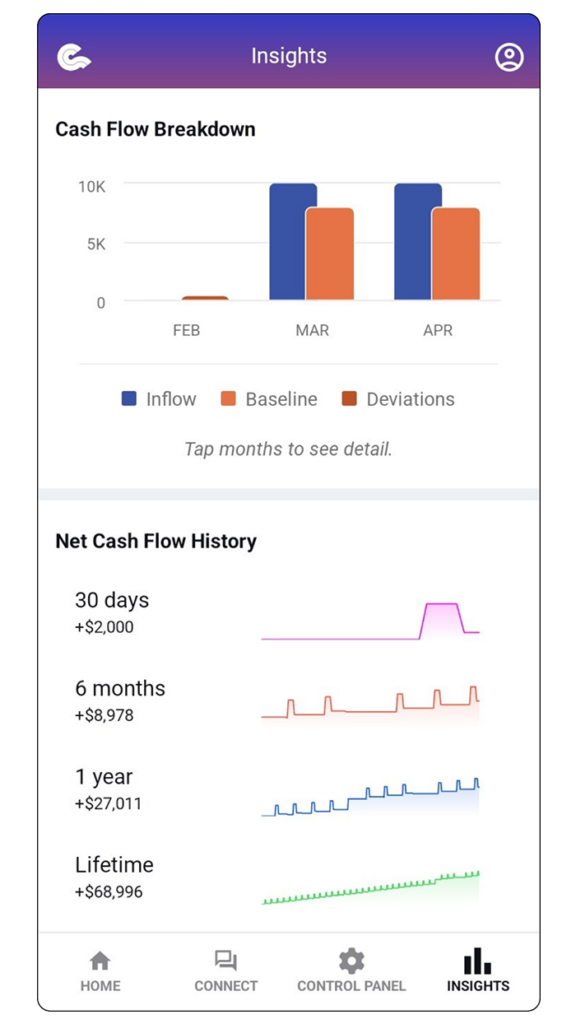

The Currence platform flows income through your central account called a Reservoir.

02

The Reservoir is a better way for you to organize your income and your spending, making it easier to control your net cash flow.

03

This then creates the opportunity for you to increase wealth accumulation with smarter spending and saving choices.

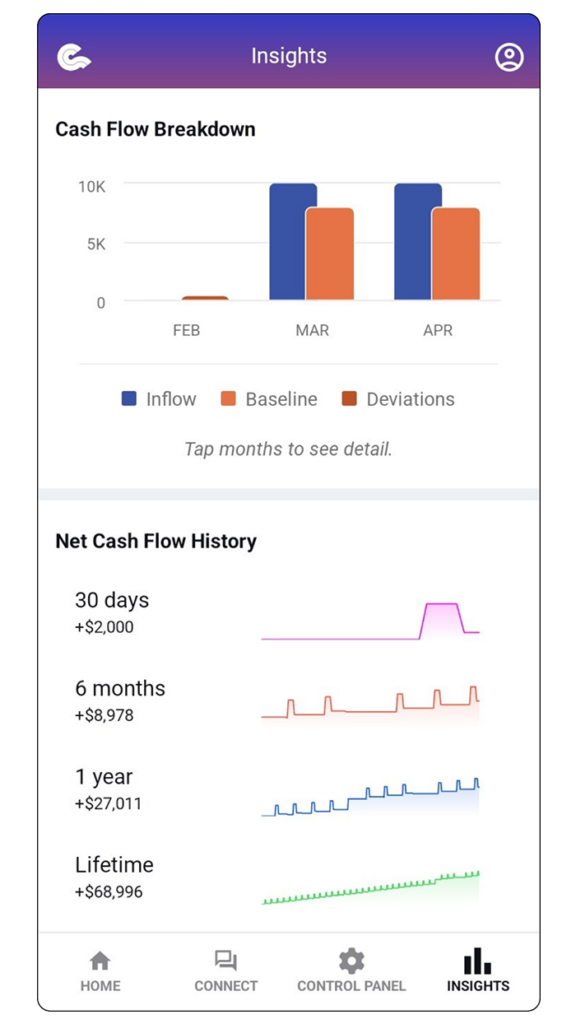

Get better visibility and insights to your cash flow health when you connect all your accounts, plus competitive interest rates for faster returns than a traditional savings account. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

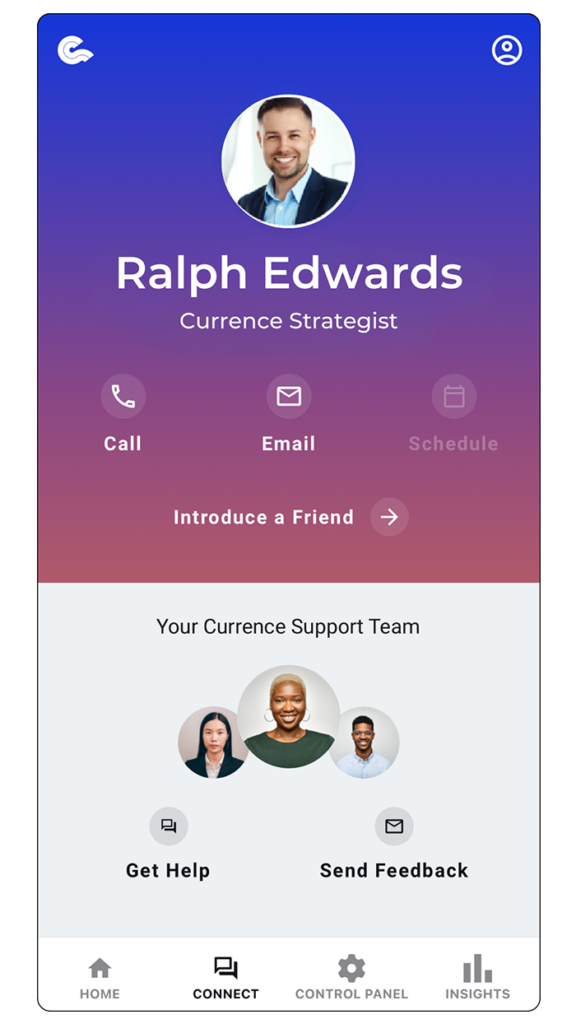

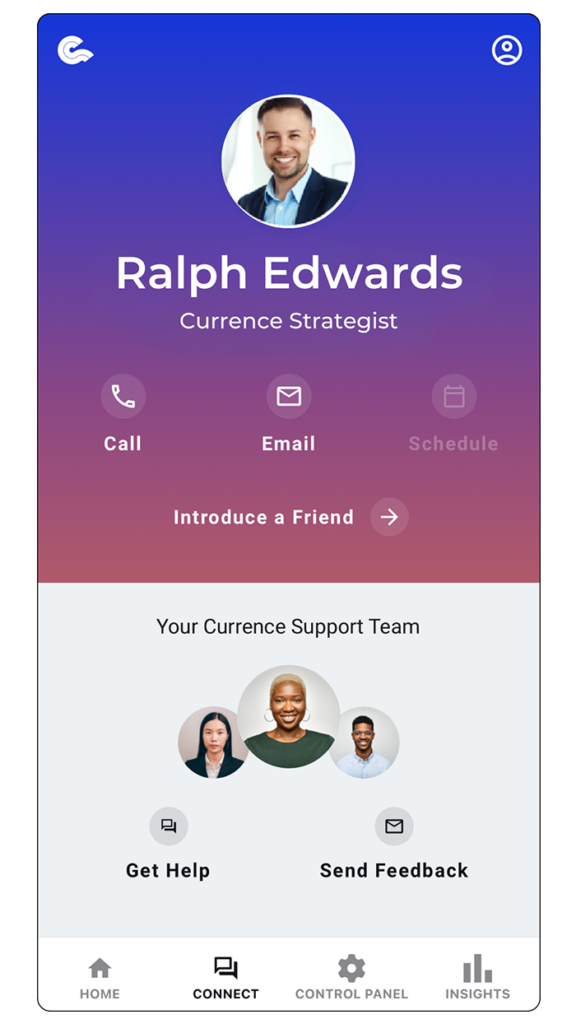

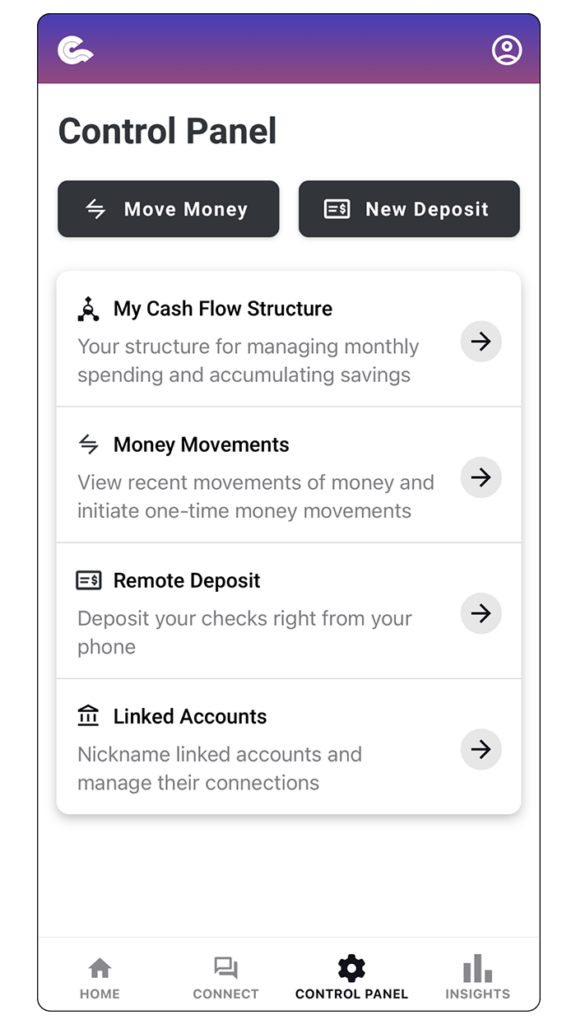

Streamline cash flow management alongside a financial professional or unlock effective money management on your own.

Cultivate and integrate new income streams as savings increase, amplifying opportunities to invest in the future over time.

Get better visibility and insights to your cash flow health when you connect all your accounts, plus competitive interest rates for faster returns than a traditional savings account. FDIC Insurance up to $3M available.

Streamline cash flow management alongside a financial professional or unlock effective money management on your own.

Cultivate and integrate new income streams as savings increase, amplifying opportunities to invest in the future over time.

Higher savings rate than the national average**

Users who have trusted Currence with their finances

Transactions at no additional cost

$40 every 90 days following

"Currence as a tool for creating healthy cash flow has been so beneficial to my wife and me. The dollars you will see stored each month for future you (and your family) are incredible. You should reach out and incorporate it. You in even a year from now will thank you for establishing the structure."

Joshua

Virginia Beach, VA

"This app has been a game changer for me. It’s helped me create a structure around my cash flow, all in an easy to use app! I recommend this app to all people, young and old, to get a handle on their savings rate and to start building real wealth."

@NWINT13

App Store Review

Currence is free for the first 90 days, and then $40 every 90 days, however pricing may vary depending upon referral/enrollment plan. The account fee covers: unlimited ACH transactions, a competitive interest rate, connectivity to your Currence strategist (if applicable), access and maintenance of the mobile app, along with technical support and documentation.

You can create an account and try it out, you will not be charged until the 91st day. Cancel any time before your 91st day at no charge.

For more information, read our disclosure and privacy policy.

After you open your account, you can invite a joint account holder so that you and your partner can maximize your cash flow. Follow the app tour and you’ll see how easy it is.