63 reviews on App store

"Using Currence has simplified and sped up my ability to save up money to use for my future investments and big purchases. I also like that it automates my savings very effectively."

Les

Member

"I just wanted to send a note of gratitude. I’ve implemented Currence into my new client on-boarding process, as well as introducing Currence to existing clients. In the last 3-4 months since I started utilizing Currence, I’ve noticed my conversations are more powerful. I speak with more conviction, often referring back to our cash flow work with Currence. And most importantly, I’ve already started seeing more unsolicited introductions. Thank you!"

Evan

Financial Professional

"I’ve discovered something that has created a new possibility for my cash flow management. It disconnects my consumption from my income as it rises, ultimately capturing more assets for my savings and retirement accounts that have been evaporating into my standard of living…."

Jeffrey

Member

“Currence is the perfect tool for someone that wants to build a “service” practice. Currence is not only a tool but a mindset. It has challenged me to be more efficient and put the client in the best position to make decisions. There is no better tool in the world to provide a true service practice, and it has quickly changed my career, my clients’ careers, and increased my passion about the work we do.”

Brennan

Financial Professional

Some users save up to 6X the national average**

Individuals who have trusted Currence with their finances

Financial professionals using Currence

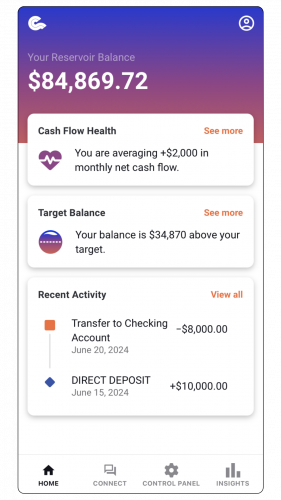

Currence makes financial management easier, allowing for higher savings growth.

01

Financial professional joins Currence as a Strategist

02

Strategist invites client(s) to Currence

03

Client joins, links financial accounts

Now, both the advisor and client have real-time full visibility of their cash flow.

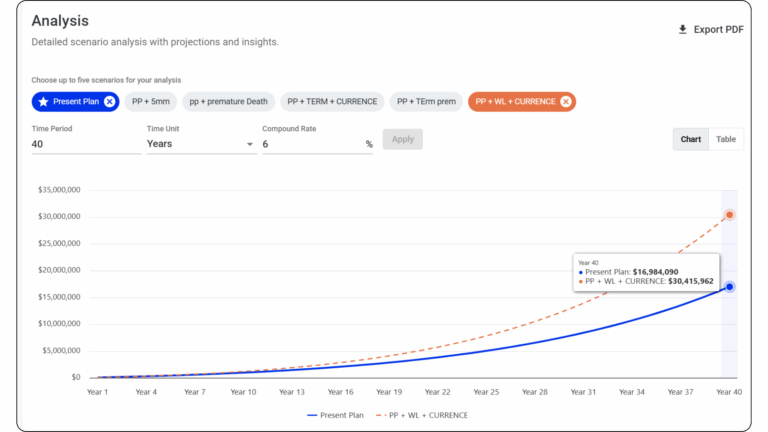

Built to uncover opportunities and spark actionable conversations, the Cash Flow Simulator empowers clients to see where their money is going and how to redirect it toward their goals. The Cash Flow Simulator allows clients and advisors alike to visualize real income, expenses, and cash flow patterns in minutes.

What the Cash Flow Simulator can help do:

✅ Quickly identify gaps and cash flow inefficiencies

✅ Build a hyper-personalized action plan in minutes

✅ Boost client clarity and confidence during onboarding

✅ Start planning for income, taxes, and protection sooner

The Cash Flow Simulator is available exclusively to Currence Certified Income Advisor (CIA) plan members.