The Future of Financial Advisory

OneAmerica Financial Agents get exclusive access to savings on Currence plans. Grow your practice, access experts, join segment-specific training, enhance your brand, and earn passive income.

In the press

Find the money

Help clients increase savings rate 6x more

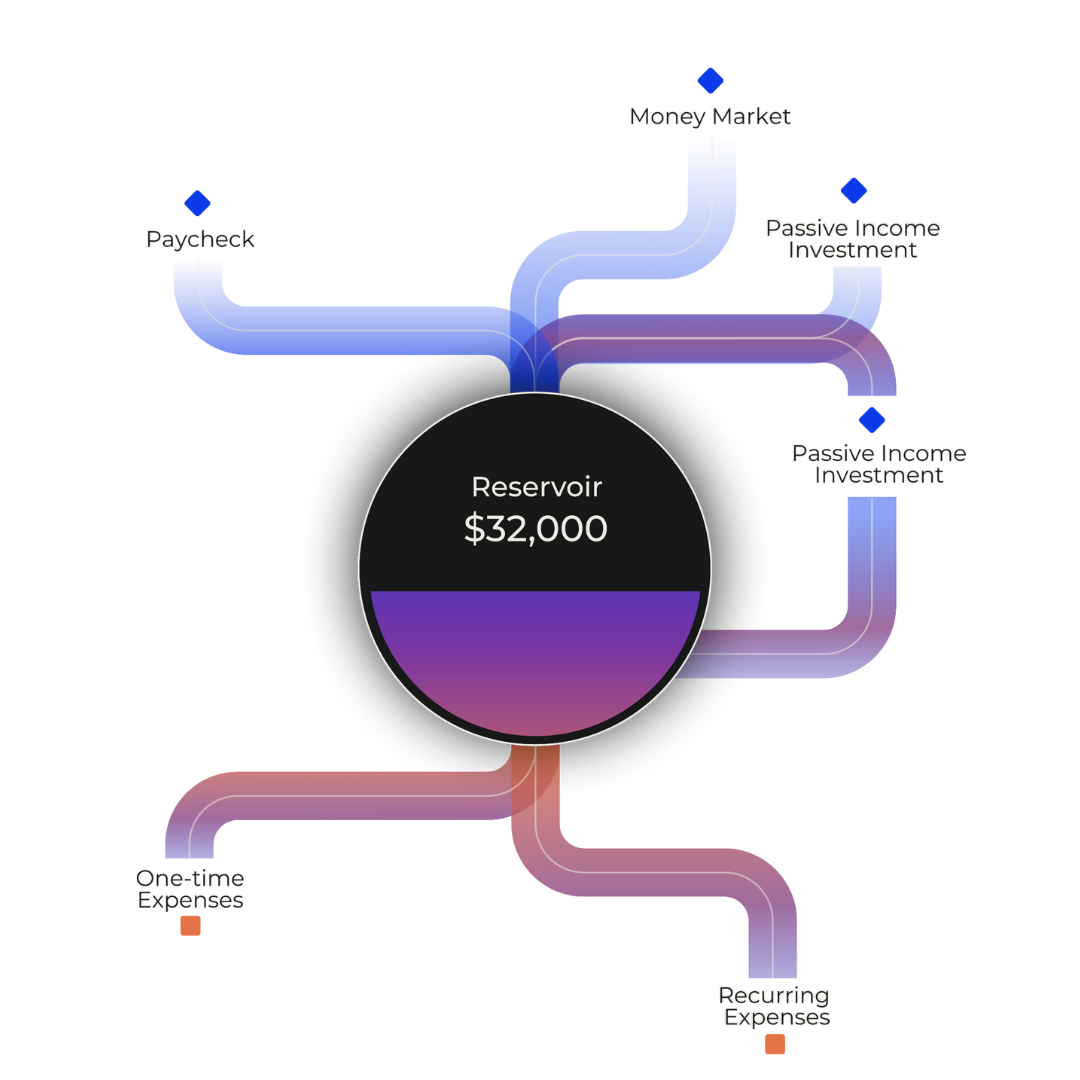

Flip the switch on the traditional cash flow food chain by helping your clients to save first. This change of direction in cash flow drives savings accumulation with upwards of 6x higher savings rates than the national average. Move yourself up the food chain to realize these benefits:

- Influence all of your clients’ income, not what’s leftover

- Create a steady stream of new resources to put to work

- Realize faster decisions from increased client confidence

Find the people

Gain more clients

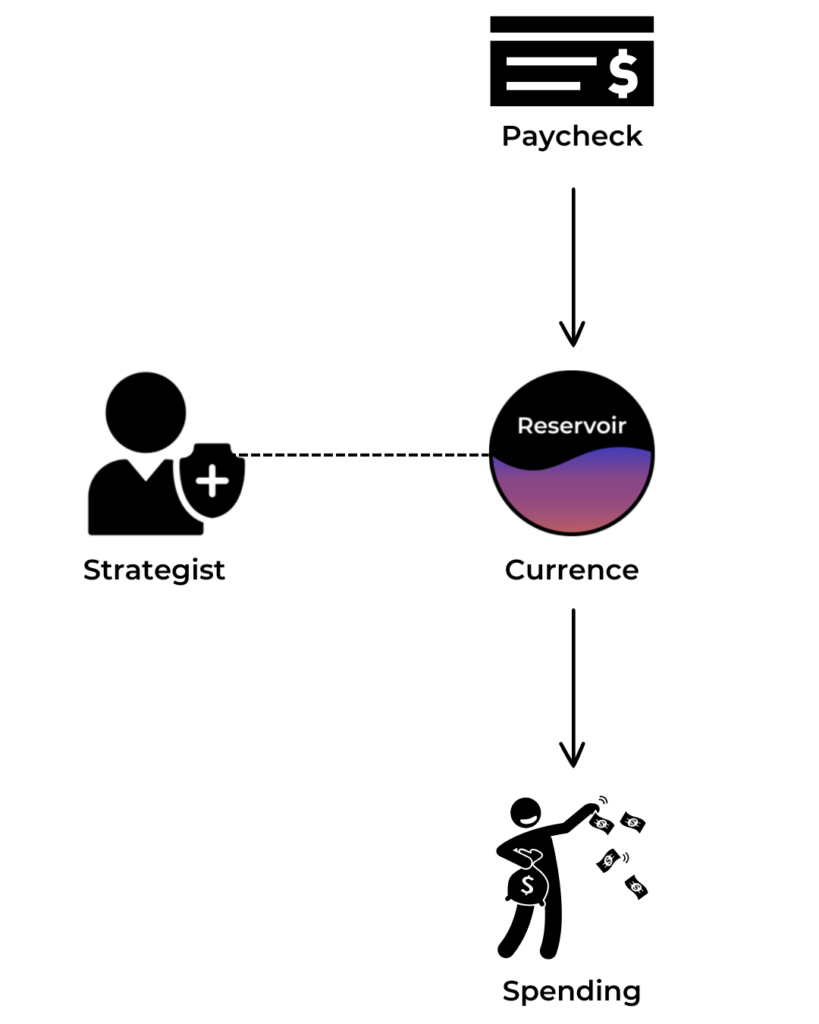

Differentiate yourself as an income advisor with Currence’s IUM approach. Help your clients make the best choices to grow and protect their wealth with a steady stream of investible cash. As a cash flow expert and income advisor you will gain these advantages:

- Open 97% of market, rather than competing for the 3% with everyone else

- Witness your B+C clients ‘magically’ convert themselves to A clients

- Gain effortless referrals moving upmarket to higher net worth individuals

Keep them both

Cut down client meeting time by 75%

Give clients more confidence to make choices that will improve their financial position with Currence. This will save you both a tremendous amount of time, with a common language and clearly defined rules of engagement.

Improve client outcomes and grow your business.

- Gain your time back for personal or professional growth

- Create a legion of loyal clients that become your best lead source

- Increase client retention as their confidence grows

Differentiate yourself as an advisor

Unlock the Currence CIA program and be empowered to support your clients toward their utmost wealth potential. This exclusive program will differentiate you from other advisors, making you an expert in managing income and cash flow. It’s a win-win for both you and your clients!

OneAmerica is working with Currence to support your financial practice. Watch the replay of our co-hosted information session here:

Why currence?

A VIP group of elite advisors

If you’ve been looking for a way to up your financial advisory game, this is the way! Be a part of the future of financial advising while still improving your practice in the short-term. Strategists like you get these benefits:

Up to 2X income in your first 12 months

Move upmarket to higher net worth individuals

Get effortless referrals

Get time back by cutting down client meetings by 75%

B+C clients ‘magically’ convert themselves in to A clients

Q&A

Frequently asked questions

What does Currence cost?

Claim your $150 subsidy on your Currence plan through our relationship with OneAmerica. Get Currence CIA upgrade FREE for 2 months, including trainings, marketing assets, and all Premium plan benefits.

What does Currence cost my clients?

The cost of Currence for your clients is $40 every 90 days, however pricing may vary depending upon referral/enrollment plan. The account fee covers: unlimited ACH transactions, a competitive interest rate, connectivity to you as their strategist, access and maintenance of the mobile app, along with technical support and documentation.

Is Currence secure?

Currence is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. FDIC insurance available up to $3M for funds on deposit through Thread Bank, Member FDIC.* For more information, read our disclosure and privacy policy.

How do I share Currence with my team?

With a paid subscription, you can collaborate and delegate making you that much more efficient. Delegation allows you to leverage your team to help service your entire customer book. Collaboration allows you to share data on a specific client or set of clients for specialized team-based approach.

Get started.

Fill out this form to register as a Currence Strategist.