DISCLOSURE:

Currence is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. FDIC insurance available for funds on deposit through Thread Bank, Member FDIC. Pass-through insurance coverage is subject to conditions.

*Your deposits qualify for up to $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://thread.bank/sweep-disclosure/ and a list of program banks at https://thread.bank/program-banks/. Please contact [email protected] with questions on the sweep program. Pass through insurance coverage is subject to conditions.

There is no guarantee of accumulation and free cash flow. Non-deposit investment accounts linked to Currence are not FDIC insured and FDIC insurance does not protect you against Currence’s insolvency or bankruptcy.

The claim “open 97% of market, rather than competing for the 3% with everyone else” is based on Currence suggestion that most advisors focus on the 3% of the available market that are ready to buy, rather than the 97% that may require further nurturing, according to the Pyramid of Purchase Stage in Consumer Behavior.

**The claim that some Currence clients’ personal savings rate can be up to 6x the national average is based on a comparison between the average personal savings rate of certain Currence clients meeting specific criteria and the national average personal savings rate as reported by the Federal Reserve Economic Data (FRED) site.

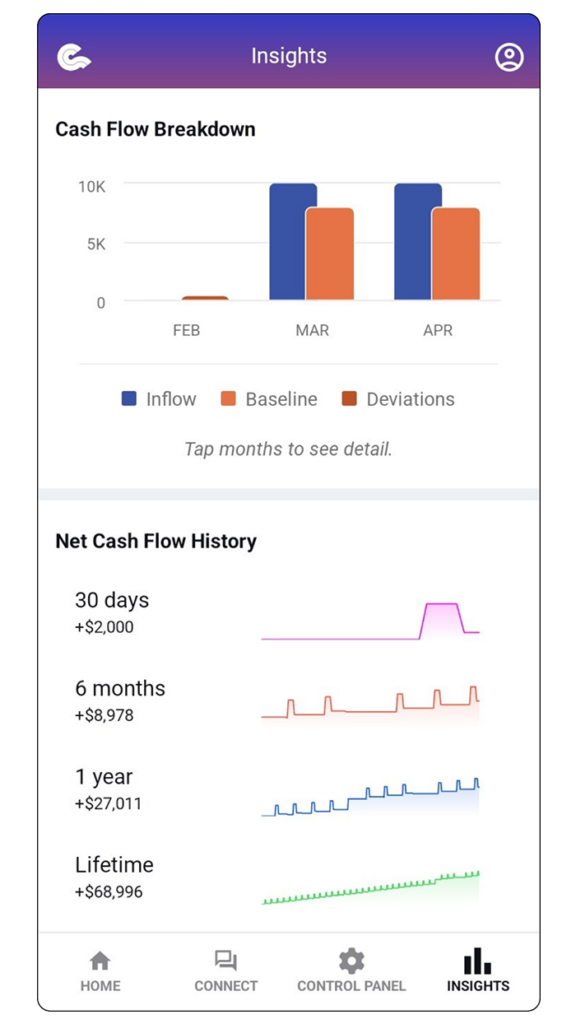

National Average Personal Savings Rate: According to the FRED data, the national average personal saving rate as of Mar 2025 is 4.3%. This rate is calculated as the ratio of personal saving to disposable personal income (DPI), where personal saving is defined as personal income less personal outlays and personal taxes.

Currence Personal Savings Rate: The personal savings rate for Currence clients is calculated as the ratio of net cashflow to inflows, where net cash flow is defined as inflows (i.e. salary, bonus, dividends, or other income) less outflows (i.e. mortgage, utility bills, other expenses) across a sample that includes clients who have been actively using the platform more than 365 days as of November 14, 2024, and have annual inflows greater than $40,000 (32% of all Currence users). This group of Currence clients have an average personal savings rate that is 23.6% as of November 14, 2024.

Individual results may vary. The personal savings rate for each client depends on various factors including but not limited to income, spending habits, and financial goals. The comparison highlights the significant savings advantage experienced by Currence clients relative to the national average, but it does not guarantee similar results for every individual.

This material is for general informational purposes only and is not investment advice nor does it constitute an offer, recommendation or solicitation to buy or sell a particular financial instrument, or engage in any particular saving or investing strategy. It does not have regard to the specific investment objectives, financial situation, risk profile or the particular needs of any specific person who may receive this material. No representation is made that the information contained herein is accurate in all material respects, complete or up to date, nor that it has been independently verified by us. Historic performance is not indicative of future results and investors should understand that statements regarding future prospects may not be realized. Currence makes no representation that any account will or is likely to achieve profits or losses similar to those shown. All investments entail risk, including potential complete loss of principal invested. Performance of investments may vary significantly.

This material, including all opinions, estimates and other information, is subject to change without notice. The price, value of and income from any of the strategies mentioned in this material can fall as well as rise. Any market valuations contained herein are indicative values as of the time and date indicated and we do not warrant their completeness or accuracy and are subject to change without notice. We disclaim any and all liability relating to the information herein, including without limitation any express or implied representations or warranties for, statements contained in, and omissions from, the information. We are not liable for any errors or omissions in such information or for any loss or damage suffered, directly or indirectly, from the use of this information. No proposed customer or counterparty relationship is intended or implied between us and any recipient of this material. Currence does not provide investment, tax, or legal advice, and will not advise as to the investment, tax, or legal consequences of using Currence’s products and services. Any opinions offered by Currence regarding Currence’s products are not legal, tax, or investment opinions, are not statements of fact, and are not to be relied on by anyone for any purpose. All content that Currence produces or provides may contain errors and customers should not base investment decisions solely on any content Currence produces or provides. It is important that customers consult their own investment, financial, tax, and/or legal advisers with any questions they have regarding the consequences of any purchase, sale, investment, or strategy. Currence does not sell any product which is exempt from applicable taxes.